We design solutions that help financial institutions unlock agility, deliver customer impact, and drive sustainable growth.

Strategy & Digital Consulting for BFSI

Want to modernize a legacy system or launch a new digital product? We help you define the right roadmap — from compliance to cloud migration to go-to-market planning.

Custom BFSI Software Development

We design and build scalable solutions: mobile banking apps, AI-powered insurance portals, robo-advisors, and more. Everything is built around your needs.

AI, Predictive Analytics & Decision Support

Turn raw data into revenue. Predict churn, personalize insurance plans, or optimize credit scoring with our AI toolkits built specifically for BFSI.

Testing & QA for Regulated Environments

Secure, stable, and compliant. Our QA teams ensure that what you launch is both user-friendly and audit-ready.

Proven Track Record in Regulated Finance

We’ve helped banks, insurers, and fintechs modernize systems while meeting strict compliance standards.

Transparent, Collavborative Project Delivery

Transparent, collaborative BFSI solutions that keep high-stakes projects predictable.

Security-First, Compliance-Ready Architecture

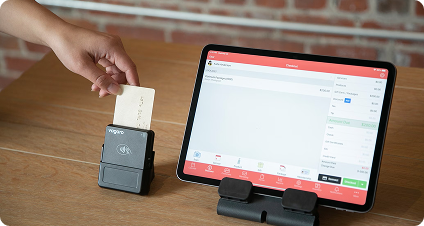

We embed security and compliance by design — from core banking to digital payments.

AI/ML Expertise Tailored to BFSI Needs

AI-driven fraud detection, credit scoring, engagement, and efficiency — built around users.

We offer tailored solutions, including core banking modernization, digital customer experience platforms, insurance automation, fintech app development, and risk management systems.

Security is essential in BFSI because institutions handle sensitive financial and customer data. Our BFSI solutions integrate encryption, authentication, and monitoring to protect data and build customer trust.

Yes. We understand each BFSI segment has unique needs, and we design customized solutions aligned with your business goals, whether it’s streamlining operations, launching digital banking apps, or improving customer journeys. Talk to our BFSI experts about a solution built for your business.

Security is built into every layer — from encrypted data pipelines to role-based access and audit trails. We follow global compliance standards like GDPR, PSD2, HIPAA, and OWASP best practices.

Our teams stay up to date with evolving regulatory frameworks and work closely with your compliance teams to ensure everything we deliver is audit-ready and regulation-compliant.